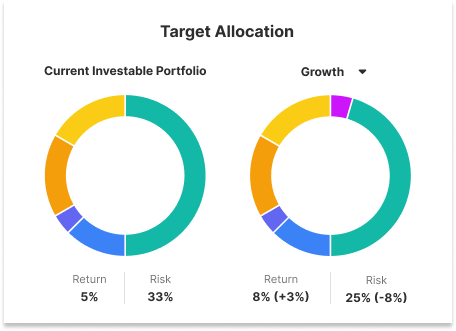

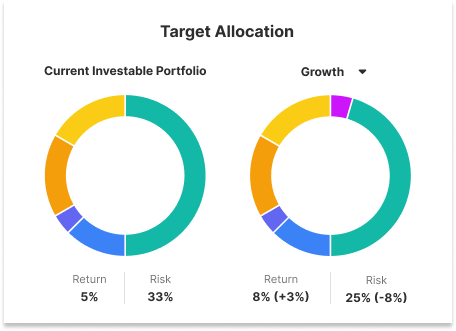

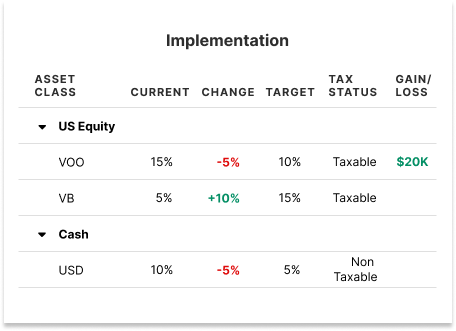

Target Allocations

Dial in a prospect's longterm goals by building a custom portfolio

Demonstrate Expertise

Compare a prospect's portfolio to a recommended portfolio

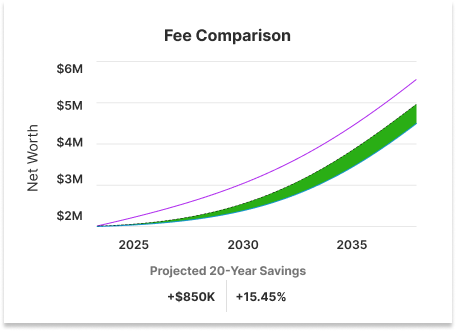

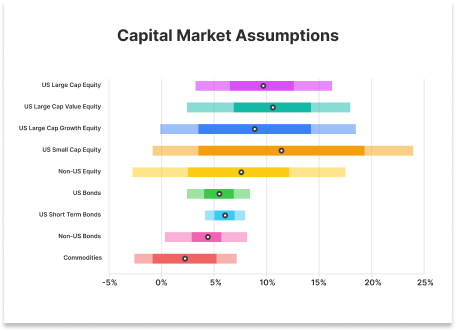

Customize Data

Upload your capital market assumptions and target portfolios

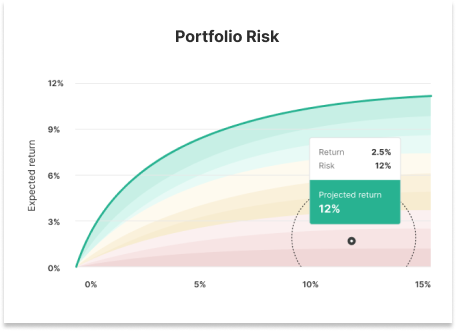

Out of the Box

Incorporate institutional grade return and risk data